The following analysis considers the 226 major publicly listed automobile companies with a market capitalisation above $1 billion. The numbers in the tables are expressed in millions of dollars except for percentages and ratios.

If you are looking for more comprehensive historical data about the automobile industry, please refer to this page contaning the most relevant industry data going back to 2012.

Summary:

- Industry Overview

- Industry Performance

- Industry Growth Forecasts

- Regulations and Geopolitical Risks

- Market Share and Competitors Analysis

- Selected Company Valuation

Industry Overview

The automobile industry is composed of all those companies whose activities revolve around the development and manufacture of vehicles and vehicle parts.

The Vehicle Manufacturing segment includes companies that manufacture cars, SUVs, light trucks, heavy-duty trucks, buses, and recreational vehicles.

The Vehicle Parts Manufacturing segment includes companies that manufacture engines, engine parts, automotive electrical equipment, steering and suspension components, brake systems, transmission systems, seating and interior equipment, stamps, airbags, exhausts, HVAC units, and all other key auto-components.

The Vehicle Body and Trailer Manufacturing segment includes companies that manufacture vehicle bodies (chassis), truck trailers and semi-trailers, travel trailers, camper equipment, and all other essential components of vehicles.

Industry Concentration & Dynamics Analysis

The automobile industry is significantly affected by general economic conditions.

Vehicles are durable goods, and the decision of whether to purchase a vehicle is very sensible. It may be significantly affected by sluggish economic conditions, geopolitical events, and other factors including interest rates, cost of fuel, and electric vehicle charging availability and cost.

Market share is influenced by how products are perceived by customers in comparison to those offered by other manufacturers based on many factors, including price, quality, styling, reliability, safety, fuel efficiency, functionality, sustainability, and reputation.

Notably, despite the presence of strong legacy automakers, the automobile industry is very competitive registering a Herfindahl–Hirschman index (HHI index) of 0.03, or 333.6 points.

The Herfindahl–Hirschman index is used to measure the level of competitiveness/concentration in an industry with HHI below 0.15 (or 1.500 points) indicative of unconcentrated, or very competitive, industries; HHI between 0.15 and 0.25 (or 1.500 and 2.500 points) indicative of moderately concentrated industries; and HHI above 0.25 (or 2.500 points) suggesting that industries are highly concentrated, or scarcely competitive, like oligopolies.

Although in recent times supply disruptions have resulted in near-term upward pressure on new vehicle prices, the industry has historically had a very competitive pricing environment, driven in part by excess capacity. For the past several decades, manufacturers typically have offered price discounts and other marketing incentives to provide value for customers and maintain market share and production levels.

Industry Performance

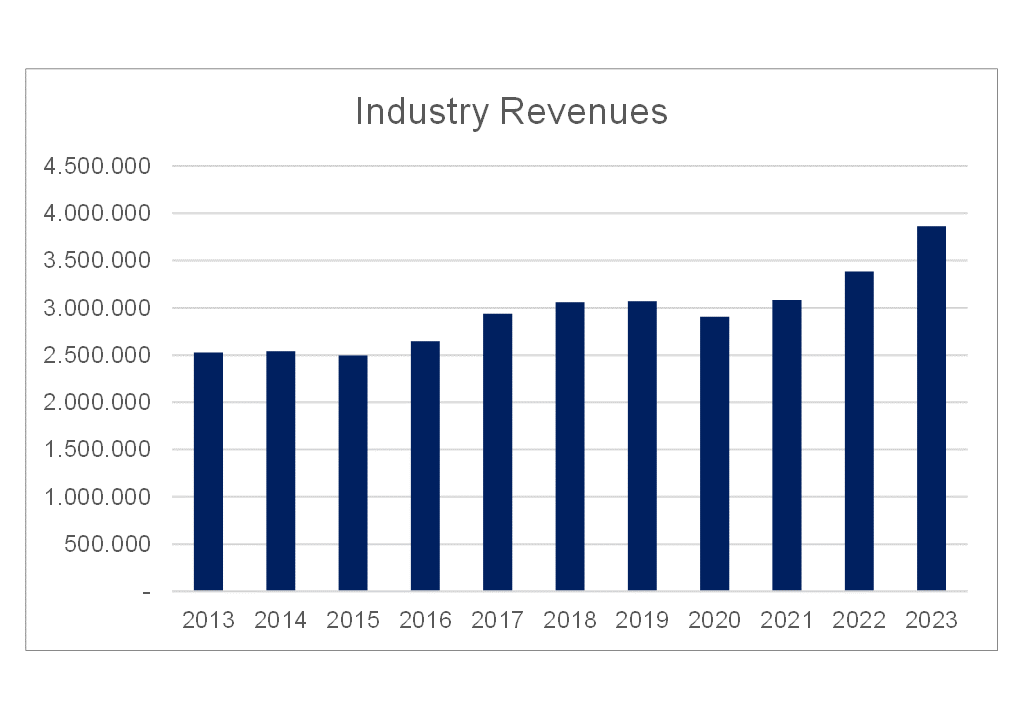

From 2013 to 2023, the industry’s revenues grew at a CAGR of 4.3%, increasing 1.53 times from $2.52 trillion to $3.87 trillion.

Profitability Metrics

As of the end of 2023, the industry’s operating margin stood at 7.1%, reflecting better performance with the industry median value of 6.5% of the past decade. The total operating profit was $275.8 billion in 2023.

Looking at other measures of profitability, in 2023 the gross margin sat at 18.8%, in line with the median value of 18.8%, while the free cash flow margin was 2.4% – better than the past decade’s median value of 1.5%.

| 2023 Profitability Metrics | |

| Gross Margin | 18,8% |

| Operating Margin | 7,1% |

| FCFF Margin | 2,4% |

| 10Y Profitability Metrics | |

| Gross Margin | 18,8% |

| Operating Margin | 6,5% |

| FCFF Margin | 1,5% |

by BlackNote Investment

Collectively in 2023, the free cash flows to the firm (FCFF) registered a value equal to $93.5 billion.

| Year | FCFF |

| 2023 | 93.526 |

| 2022 | 75.323 |

| 2021 | 101.403 |

| 2020 | 38.771 |

| 2019 | 38.836 |

| 2018 | 41.342 |

| 2017 | 46.833 |

| 2016 | 40.620 |

| 2015 | 35.357 |

| 2014 | 36.396 |

| 2013 | 38.170 |

by BlackNote Investment ($ millions)

In the automobile industry, FCFFs are highly influenced by the ability of automakers to manage working capital needs, as changes in inventory, account receivables, and account payables are crucial determinants of how much cash a company can generate.

The cash conversion cycle (CCC) ratio is a good metric to compare automakers’ ability to manage working capital as it measures the length of time it takes a firm to turn inventory investments into cash.

Among the top companies operating in the automobile industry, the median CCC ratio is 27.3 days. The lower the CCC ratio, the greater the firm’s ability to generate cash from its operating activities.

It implies that firms with low CCC ratios have lower reinvestment needs in working capital and, thus higher free cash flows.

It’s not absurd to find companies with higher FCFFs than operating income due to negative CCC ratios, as it would indicate that their working capital needs are indirectly entirely financed by suppliers, granting them longer payment periods than the period it takes for automakers to sell finished vehicles and collect cash from customers.

However, negative CCC ratios are unlikely to be sustainable in the long run.

Financial Ratios

As regards solvency ratios, the debt-to-enterprise value ratio for the automobile industry is 16.6%, while the debt-to-equity ratio is 36.1%.

The interest coverage ratio instead, showing how much the operating income covers interest expenses, is equal to 10.48, which would translate into a credit rating for the automobile industry equal to Aaa/AAA based on Moody’s rating standards.

Finally, the unlevered beta of the automobile industry – which is the beta depurated by the debt leverage – has been 0.65, for the past 2 years, and 0.86, for the past 5 years.

| Solvency Ratios | |

| Debt to EV | 16,6% |

| Debt to Equity | 36,1% |

| Interest Coverage | 10,48 |

| Rating | Aaa/AAA |

| Spread | 0,69% |

| Beta | |

| Unlevered Beta 2 y | 0,65 |

| Unlevered Beta 5 y | 0,86 |

by BlackNote Investment

Industry Growth Forecasts

Despite lower-than-anticipated electric vehicle adoption rates, which have led legacy automakers to adjust spending, production, and product launches of new energy vehicles (NEVs), it’s clear that NEVs are the future of the automobile industry with automakers that, sooner or later, will be forced by legislators to cease the production of internal combustion engine (ICE) vehicles to promote more sustainable means of transportation.

Other than a secular switch in vehicles’ powering systems, which will boost the sale of new vehicles throughout the next decade, emerging economies – especially Asian ones like Thailand, India, Indonesia, Taiwan, and China for a lesser part – are expected to drive the demand for new cars.

To capitalize on such opportunities, over the past decade, collectively the industry registered a median reinvestment margin of 4.5%, which comprises investments made in capital expenditures, R&D, and acquisitions.

In terms of efficiency and return on investments, the automobile industry median sales to invested capital in the period 2013-2023 is equal to 1.16, meaning that on every one dollar invested the industry generates $1.16 of revenues.

Combining both the reinvestments made through the past decade and the industry’s ability to generate a return from the investments made, the 2024 expected growth rate for the industry is 5.1%. A detailed explanation of how we came up with the industry’s expected growth rate, as well as many more useful industry data, can be found in this post.

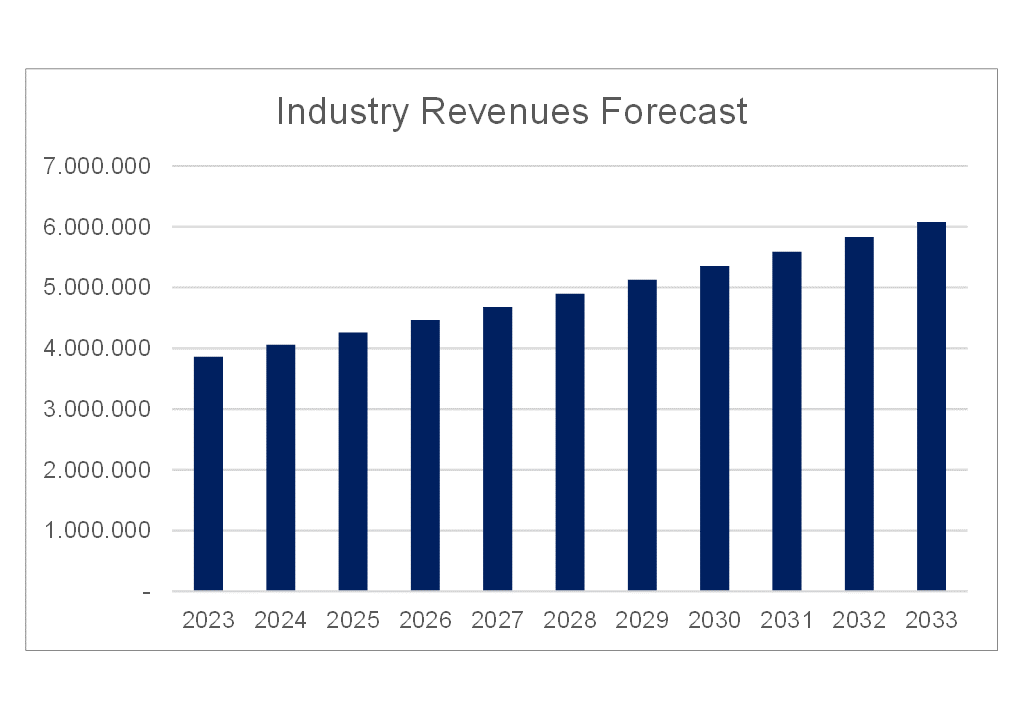

By 2033, the automobile industry revenues are expected to reach $6.07 trillion, increasing 1.57 times from the $3.87 trillion registered in 2023 at a CAGR of 4.6%. We projected the industry’s expected revenues 10 years from now, applying the expected growth rate of 5.1% and allowing it to slowly decline as the industry approaches the economy’s perpetual growth rate, represented in this case by the USD risk-free rate.

by BlackNote Investment

| Automobile Industry Revenues Forecast | |

| 2023 | 3.863.231 |

| 2024 | 4.059.154 |

| 2025 | 4.260.888 |

| 2026 | 4.468.406 |

| 2027 | 4.681.671 |

| 2028 | 4.900.638 |

| 2029 | 5.125.254 |

| 2030 | 5.355.460 |

| 2031 | 5.591.185 |

| 2032 | 5.832.356 |

| 2033 | 6.078.890 |

by BlackNote Investment ($ millions)

Regulations and Geopolitical Risks

Automakers are subject to a complex set of regulatory regimes throughout the world in which vehicle safety, emissions and fuel economy regulations have become increasingly stringent and the related enforcement regimes increasingly active, ultimately affecting vehicle sales and profitability.

Other than broad market regulations, the automobile industry is at the mercy of geopolitical tensions, primarily between China and major Western economies, which culminate in trade wars and the enforcement of tariffs on exported goods.

To help Chinese manufacturers overcome the severe economic downturn which has been affecting the country in recent times, the Chinese government has bestowed upon the industrial sector, including the electric vehicle segment, massive support measures.

This support comes in many forms, from subsidized loans to tax incentives, with the results being pouring money into Chinese manufacturers’ pockets, lowering production costs, and enabling them to sell goods at lower prices to attract more customers.

Ultimately, this flow of seemingly free money significantly increased the competition in the Chinese automotive market, driving down prices. However, due to the poor internal demand, Chinese automakers like BYD have seen fit to sell their low-priced goods overseas, especially targeting Europe, raising concerns of unfair competition and national security threats among Western governments.

EU’s response didn’t take long to arrive, as it imposed tariffs on Chinese imported vehicles ranging from 17.4% to 38.1% – depending on the degree of cooperation shown by Chinese automakers in admitting unfair state support – which would add to the already existing tariff of 10% on cars imported into the EU, bringing the maximum tariff to a whopping 48%.

Although the EU aim is to prevent a price war among European automakers to counter Chinese subsidized vehicles – which would inevitably drive down profits and limit future investments – Western automakers – especially those operating in the premium segment less impacted by new cheap vehicles entering the market – openly criticised the tariffs, arguing that any retaliation from the Chinese government on western imported vehicles will inevitably deteriorate the sales and profits of legacy automakers which heavily rely on the growing Chinese economy to sell their cars.

Given the risks imposed by geopolitical tension, automakers are expected to increase their presence in markets in which their vehicles are sold, expanding production capabilities beyond their home markets and reducing their exposure to trade restrictions and tariffs.

Market Share and Competitors Analysis

The industry is highly competitive and no company has a dominant position. The following table provides a snapshot of the top 30 companies in the automobile industry accounting for 75.2% of total market share by revenues.

| Company | 2023 Revenues | % 2023 Market Share | Rank |

| Volkswagen AG | 355.800 | 9,2% | 1° |

| Toyota Motor Corporation | 310.050 | 8,0% | 2° |

| Stellantis N.V. | 209.260 | 5,4% | 3° |

| Ford Motor Company | 176.190 | 4,6% | 4° |

| General Motors Company | 171.840 | 4,4% | 5° |

| Bayerische Motoren Werke Aktiengesellschaft | 171.670 | 4,4% | 6° |

| Mercedes-Benz Group AG | 169.150 | 4,4% | 7° |

| Honda Motor Co., Ltd. | 137.490 | 3,6% | 8° |

| Hyundai Motor Company | 125.540 | 3,2% | 9° |

| SAIC Motor Corporation Limited | 101.360 | 2,6% | 10° |

| Tesla, Inc. | 96.770 | 2,5% | 11° |

| Nissan Motor Co., Ltd. | 87.020 | 2,3% | 12° |

| BYD Company Limited | 79.260 | 2,1% | 13° |

| Kia Corporation | 77.030 | 2,0% | 14° |

| Renault SA | 57.820 | 1,5% | 15° |

| Tata Motors Limited | 50.930 | 1,3% | 16° |

| DENSO Corporation | 50.510 | 1,3% | 17° |

| Hyundai Mobis Co.,Ltd | 45.730 | 1,2% | 18° |

| Continental Aktiengesellschaft | 45.730 | 1,2% | 19° |

| Dr. Ing. h.c. F. Porsche AG | 44.740 | 1,2% | 20° |

| Magna International Inc. | 42.800 | 1,1% | 21° |

| Volvo Car AB (publ.) | 39.600 | 1,0% | 22° |

| Suzuki Motor Corporation | 36.010 | 0,9% | 23° |

| Aisin Corporation | 34.900 | 0,9% | 24° |

| Mazda Motor Corporation | 33.320 | 0,9% | 25° |

| Subaru Corporation | 31.660 | 0,8% | 26° |

| Compagnie Générale des Établissements Michelin Société en commandite par actions | 31.290 | 0,8% | 27° |

| Sumitomo Electric Industries, Ltd. | 30.610 | 0,8% | 28° |

| Bridgestone Corporation | 30.600 | 0,8% | 29° |

| Forvia SE | 30.080 | 0,8% | 30° |

by BlackNote Investment ($ millions)

Market Share Forecasts

Basing our assumptions on analysts’ expectations (source: TIKR Terminal) and industry trends, we have estimated the future market share by 2033 for the top 20 companies operating in the industry and how their market position will change compared to 2023 levels.

| Company | 2033 Revenues | % 2033 Market Share | Change | Rank |

| Volkswagen AG | 508.892 | 8,4% | - | 1° |

| Toyota Motor Corporation | 448.809 | 7,4% | - | 2° |

| Tesla, Inc. | 273.550 | 4,5% | 8 ↑ | 3° |

| Ford Motor Company | 258.757 | 4,3% | - | 4° |

| General Motors Company | 245.674 | 4,0% | - | 5° |

| Bayerische Motoren Werke Aktiengesellschaft | 245.525 | 4,0% | - | 6° |

| BYD Company Limited | 243.156 | 4,0% | 6 ↑ | 7° |

| Mercedes-Benz Group AG | 237.624 | 3,9% | 1 ↓ | 8° |

| Stellantis N.V. | 200.603 | 3,3% | 6 ↓ | 9° |

| Honda Motor Co., Ltd. | 188.446 | 3,1% | 2 ↓ | 10° |

| Hyundai Motor Company | 179.241 | 2,9% | 2 ↓ | 11° |

| SAIC Motor Corporation Limited | 145.929 | 2,4% | 2 ↓ | 12° |

| Nissan Motor Co., Ltd. | 120.373 | 2,0% | 1 ↓ | 13° |

| Kia Corporation | 114.412 | 1,9% | - | 14° |

| Renault SA | 81.342 | 1,3% | - | 15° |

| Tata Motors Limited | 73.343 | 1,2% | - | 16° |

| DENSO Corporation | 69.123 | 1,1% | - | 17° |

| Dr. Ing. h.c. F. Porsche AG | 66.868 | 1,1% | 2 ↑ | 18° |

| Hyundai Mobis Co.,Ltd | 66.281 | 1,1% | 1 ↓ | 19° |

| Continental Aktiengesellschaft | 63.818 | 1,0% | 1 ↓ | 20° |

by BlackNote Investment ($ millions)

The shift towards NEVs will shake the hierarchies in the automobile industry. Companies like Tesla and BYD, which are heavily investing in NEV technologies, are expected to gain significant market shares in the coming years.

The rise of NEV manufacturers will happen at the expense of legacy automakers still too focused on ICE vehicles, deceived by the illusion of maintaining good profitability ratios – as ICEs have higher margins than NEVs – instead of budgeting greater resources to the development of NEVs to capture future growth opportunities.

Selected Company Valuation

The following is a selection of companies operating in the automobile industry for which we present a snapshot of their operations and valuation using the DCF method.

The comprehensive analysis of the selected companies is available on our Seeking Alpha profile where you can assess all the underlying assumptions for future growth, margins, free cash flows, and the quantified risk/reward of potential investments.

BYD Company Limited ($BYDDF)

Full Analysis on Seeking Alpha

BYD is a Chinese company offering hybrid and electric vehicles mainly in China and internationally.

Over the period 2013-2023, revenues grew at a CAGR of 25.5% increasing from $8.7 billion to $84.9 billion, while its market share increased from 0.2% to 1.8%.

| BYD Company Limited Past Performance | ||||

| 2013 | 2023 | CAGR | Increase | |

| Total revenues | 8.732 | 84.859 | 25,5% | x9,7 |

| Market Share | 0,2% | 1,8% | ||

by BlackNote Investment ($ millions)

Looking at measures of profitability, the median operating margin stands at 4.4%, the median gross margin sits at 16.6%, and the median free cash flow margin is negative (6.6)% with free cash flows to the firm sitting at $3.6 billion in 2023.

| BYD Company Limited Profitability Metrics | ||

| 2023 | 10Y Median | |

| % Gross Margins | 19,8% | 16,6% |

| % Operating Margins | 5,4% | 4,4% |

| % FCFF Margins | 4,2% | (6,6%) |

by BlackNote Investment

Over the past decade, the median reinvestment margin was equal to 9.8%. In terms of efficiency, the median ROIC was 6.4% while the sales to invested capital ratio sat at 1.36.

| BYD Company Limited Efficiency Metrics | ||

| 2023 | 10Y Median | |

| % Reinvestment Margins | 0,3% | 9,8% |

| % ROIC | 28,9% | 6,4% |

| Sales To IC | 6,38 | 1,36 |

by BlackNote Investment

BYD’s market share is expected to be 4% by 2033, while its operating margin is projected to remain around 4.4%. The FCFF margins instead are expected to be 1.7%.

| BYD Company Limited Future Performance | ||||

| 2023 | 2033 | CAGR | Increase | |

| Expected Market Share | 1,8% | 4,0% | ||

| Total Revenues Projection | 84.859 | 289.923 | 13,1% | x3,4 |

| % Operating Margins Projection | 5,4% | 4,4% | ||

| % FCFF Margins | 4,2% | 1,7% | ||

| Free Cash Flows Firm Projection | 3.602 | 4.936 | 3,2% | x1,4 |

by BlackNote Investment ($ millions)

With these assumptions, using a discount rate of 11.9% in normal growth and 11.1% in perpetuity, the present value of BYD’s cash flows is equal to $54.7 billion or $18.9 per share.

Tesla, Inc ($TSLA)

Full Analysis on Seeking Alpha

Tesla is a US company offering electric vehicles all around the globe.

Over the period 2013-2023, revenues grew at a CAGR of 47.3% increasing from $2 billion to $96.7 billion, while its market share increased from 0.1% to 2.3%.

| Tesla, Inc. Past Performance | ||||

| 2013 | 2023 | CAGR | Increase | |

| Total revenues | 2.014 | 96.773 | 47,3% | x48,1 |

| Market Share | 0,1% | 2,3% | ||

by BlackNote Investment ($ millions)

Looking at measures of profitability, the median operating margin stands at negative (1.2)%, the median gross margin sits at 22.7%, and the median free cash flow margin is negative (3.1)% with free cash flows to the firm sitting at $6.8 billion in 2023.

| Tesla, Inc. Profitability Metrics | ||

| 2023 | 10Y Median | |

| % Gross Margins | 18,2% | 22,7% |

| % Operating Margins | 9,2% | (1,2%) |

| % FCFF Margins | 7,0% | (3,1%) |

by BlackNote Investment

Over the past decade, the median reinvestment margin was equal to 6.8%. In terms of efficiency, the median ROIC was negative (0.6)% while the sales to invested capital ratio sat at 2.56.

| Tesla, Inc. Efficiency Metrics | ||

| 2023 | 10Y Median | |

| % Reinvestment Margins | 6,8% | 6,8% |

| % ROIC | 37,7% | (0,6%) |

| Sales To IC | 2,73 | 2,56 |

by BlackNote Investment

Tesla’s market share is expected to be 4.5% by 2033, while its operating margin is projected to be around 17.2%. The reinvestment margins instead are expected to be 4.5%.

| Tesla, Inc. Future Performance | ||||

| 2023 | 2033 | CAGR | Increase | |

| Epected Market Share | 2,3% | 4,5% | ||

| Total Revenues Projection | 96.773 | 617.952 | 20,4% | x6,4 |

| % Operating Margins Projection | 9,2% | 17,2% | ||

| % Reinvestment Margin Projection | 6,8% | 4,5% | ||

| Free Cash Flows Firm Projection | 6.801 | 53.161 | 22,8% | x7,8 |

by BlackNote Investment ($ millions)

With these assumptions, using a discount rate of 7.6% in normal growth and 7.3% in perpetuity, the present value of Tesla’s cash flows is equal to $1.01 billion or $317 per share.

Ford Motor Company ($F)

Full Analysis on Seeking Alpha

Ford is a US company offering ICEs and NEVs all around the globe.

Over the period 2013-2023, revenues grew at a CAGR of 1.8% increasing from $146.9 billion to $176.2 billion, while its market share decreased from 5.8% to 4.6%.

| Ford Motor Company Past Performance | ||||

| 2013 | 2023 | CAGR | Increase | |

| Total revenues | 146.917 | 176.191 | 1,8% | x1,2 |

| Market Share | 5,8% | 4,6% | ||

by BlackNote Investment ($ millions)

Looking at measures of profitability, the median operating margin stands at 3.2%, the median gross margin sits at 10.6%, and the median free cash flow margin is 5% with free cash flows to the firm sitting at $5.2 billion in 2023.

| Ford Motor Company Profitability Metrics | ||

| 2023 | 10Y Median | |

| % Gross Margins | 9,2% | 10,6% |

| % Operating Margins | 3,0% | 3,2% |

| % FCFF Margins | 3,0% | 5,0% |

by BlackNote Investment

Over the past decade, the median reinvestment margin was equal to negative (2.2)%. In terms of efficiency, the median ROIC was 2.8% while the sales to invested capital ratio sat at 0.92.

| Ford Motor Company Efficiency Metrics | ||

| 2023 | 10Y Median | |

| % Reinvestment Margins | 0,4% | (2,2%) |

| % ROIC | 3,5% | 2,8% |

| Sales To IC | 1,04 | 0,92 |

by BlackNote Investment

Ford’s market share is expected to be 4.3% by 2033, while its operating margin is projected to remain around 3.2%. The FCFF margins instead are expected to be 2.5%.

| Ford Motor Company Future Performance | ||||

| 2023 | 2033 | CAGR | Increase | |

| Expected Market Share | 4,6% | 4,3% | ||

| Total Revenues Projection | 176.191 | 258.757 | 3,9% | x1,5 |

| % Operating Margins Projection | 3,0% | 3,2% | ||

| % FCFF Margins | 3,0% | 2,5% | ||

| Free Cash Flows Firm Projection | 5.232 | 6.540 | 2,3% | x1,3 |

by BlackNote Investment ($ millions)

With these assumptions, using a discount rate of 9.7% in normal growth and 7.3% in perpetuity, the present value of Ford’s cash flows is equal to $42.4 billion or $10.6 per share.

General Motors Company ($GM)

Full Analysis on Seeking Alpha

GM is a US company offering ICEs and NEVs all around the globe.

Over the period 2013-2023, revenues grew at a CAGR of 1% increasing from $155.4 billion to $171.8 billion, while its market share decreased from 6.2% to 4.4%.

| General Motors Company Past Performance | ||||

| 2013 | 2023 | CAGR | Increase | |

| Total revenues | 155.427 | 171.842 | 1,0% | x1,1 |

| Market Share | 6,2% | 4,4% | ||

by BlackNote Investment ($ millions)

Looking at measures of profitability, the median operating margin stands at 5.8%, the median gross margin sits at 11.8%, and the median free cash flow margin is 2.3% with free cash flows to the firm sitting at $6.2 billion in 2023.

| General Motors Company Profitability Metrics | ||

| 2023 | 10Y Median | |

| % Gross Margins | 11,2% | 11,8% |

| % Operating Margins | 5,6% | 5,8% |

| % FCFF Margins | 3,6% | 2,3% |

by BlackNote Investment

Over the past decade, the median reinvestment margin was equal to 3.2%. In terms of efficiency, the median ROIC was 5.2% while the sales to invested capital ratio sat at 1.14.

| General Motors Company Efficiency Metrics | ||

| 2023 | 10Y Median | |

| % Reinvestment Margins | 1,7% | 3,2% |

| % ROIC | 5,3% | 5,2% |

| Sales To IC | 0,99 | 1,14 |

by BlackNote Investment

GM’s market share is expected to be 4% by 2033, while its operating margin is projected to remain around 5.8%. The FCFF margins instead are expected to be 2.1%.

| General Motors Company Future Performance | ||||

| 2023 | 2033 | CAGR | Increase | |

| Expected Market Share | 4,4% | 4,0% | ||

| Total Revenues Projection | 171.842 | 245.674 | 3,6% | x1,4 |

| % Operating Margins Projection | 5,6% | 5,8% | ||

| % Reinvestment Margin Projection | 1,7% | 2,1% | ||

| Free Cash Flows Firm Projection | 6.117 | 5.726 | (0,7%) | x0,9 |

by BlackNote Investment ($ millions)

With these assumptions, using a discount rate of 6.6% in normal growth and 7.3% in perpetuity, the present value of GM’s cash flows is equal to $63.3 billion or $55.5 per share.

If you are looking for financial data to support your valuations, on BlackNote Investment you can find the expected growth rate for 37 different industries used to forecast companies’ future revenues.

Additionally, the site offers useful data such as equity risk premiums for 39 different countries, used for calculating discount rates, as well as expected earnings growth rates for those countries based on analysts’ expectations.

Detailed industry and sector reports are also available, containing data like total revenues, total free cash flows, median operating margins, return on capital, as well as beta and financial ratios used to assess companies’ risk.

Feel free to use them in your analysis.