The following report considers the 206 publicly listed companies operating in the electrical equipment industry with a market capitalisation above $1 billion.

The data regarding the sub-segments of the electrical equipment industry refers only to 45 companies which combined account for 75.2% of total industry revenues. We believe that this percentage permits a fair representation of the total industry.

If you are looking for more comprehensive historical data about the electrical equipment industry, please refer to this page contaning the most relevant industry data going back to 2012.

Summary:

- Industry Overview

- Industry Performance

- Megatrends

- Industry Growth Forecasts

- Market Share and Competitors Analysis

- Selected Company Valuation

Industry Overview

The electrical equipment industry involves the development and manufacturing of electrical devices, which are devices that rely on electric energy (AC or DC) to operate their core parts (electric motors, transformers, lighting, rechargeable batteries, control electronics).

More specifically, electrical equipment refers to the individual components of an electrical distribution system. These components may involve:

Electric switchboards: devices that distribute electric power from one or more sources of supply to several smaller load circuits.

Distribution boards: components of an electricity supply system that divide an electrical power feed into subsidiary circuits while providing a protective fuse or circuit breaker for each circuit in a common enclosure.

Circuit breakers and disconnects: electrical safety devices designed to protect an electrical circuit from damage caused by current in excess of that which the equipment can safely carry (overcurrent).

Transformers: passive components that transfer electrical energy from one electrical circuit to another circuit, or multiple circuits.

Electricity meter: devices that measure the amount of electric energy consumed by a residence, a business, or an electrically powered device.

Segment Analysis

The electrical equipment industry is further divided into eight sub-segments, each serving the specific needs of residential, commercial, and industrial environments.

Relay and Industrial Control Manufacturing

This category involves the manufacture of relays and industrial controls used to regulate and manage electrical systems in various applications. Products in this category are essential for the automation and control of electrical circuits in industrial, commercial, and residential settings.

Examples of products: electromechanical relays, Programmable Logic Controllers (PLC), motor starters, Variable Frequency Drives (VFD), and timers and counters.

These products are used in Industrial Automation, in manufacturing plants to control machinery and processes; Power Distribution, for controlling circuit breakers and other electrical equipment in power plants; Building Automation, like HVAC systems, lighting control, and security systems within buildings; Transportation, such as railway signalling systems, automotive control systems, and traffic light control; and to control Home Appliances.

Major markets targeted by relay and industrial control products are discrete end markets – automotive, semiconductor – hybrid end markets – food and beverage, life sciences – and process end markets – oil and gas, mining, and chemicals.

Switchgear and Switchboard Apparatus Manufacturing

This category involves the manufacturing of switchgear and switchboard apparatus, which are essential components in the management, protection, and control of electrical power systems. These devices are crucial for ensuring the safe and efficient distribution of electrical power in various applications, from industrial to residential settings.

Examples of products: switchgear, switchboards, busbars, circuit breakers, and fuses.

These products are used in Power Generation and Distribution, to manage and distribute electrical power; Industrial Facilities, for controlling and protecting electrical systems in manufacturing plants, refineries, and other industrial settings; Commercial Buildings, to distribute power and protect electrical circuits in office buildings; and in Residential Buildings, switchgear and switchboards are used for power distribution and protection in homes.

Power, Distribution, and Specialty Transformer Manufacturing

This category involves the manufacturing of transformers used for various applications in power generation, transmission, distribution, and speciality purposes. Transformers are essential for modifying voltage levels to meet the requirements of different stages of electrical power systems, ensuring efficient and safe power delivery.

These products are used in Power Generation and Transmission, used in power plants and to step up voltage for transmission and step down voltage for distribution; Industrial Facilities, used to power machinery, motors, and equipment, ensuring the right voltage levels for various industrial processes; Commercial Buildings, to provide the appropriate voltage levels for lighting, heating, ventilation, and other electrical systems; and in Residential Areas, pole-mounted and pad-mounted transformers are used to supply electricity to homes and residential complexes.

Motor and Generator Manufacturing

This category involves the manufacturing of motors and generators used in a wide range of applications across various industries. These products are essential for converting electrical energy into mechanical energy (motors) or mechanical energy into electrical energy (generators).

These products are used in Industrial Facilities, to power machinery, conveyors, pumps, fans, and other industrial equipment; Automotive, electric motors are used in electric vehicles and hybrid vehicles, while alternators are used in traditional internal combustion engine vehicles; Commercial and Residential Buildings, to provide backup power during outages; and Renewable Energy, generators are used in wind turbines and hydroelectric power plants to convert kinetic energy into electrical energy.

Battery Manufacturing

This category involves the manufacturing of batteries used to store and supply electrical energy across various applications. Batteries are crucial for powering a wide range of devices, from small electronics to large industrial systems and electric vehicles.

Other Communication and Energy Wire Manufacturing

This category involves the manufacturing of a wide range of communication and energy wires that are used to transmit electrical power or data. These wires are essential components in various applications, from telecommunications to energy distribution.

Examples of products: fibre optic cables, coaxial cables, and power cables

These products are used in Telecommunication, fibre optic and twisted pair cables are used for high-speed internet, telephone, and cable TV services; Energy distribution, power cables are used in power grids to transmit electricity from generation sites to consumers; Industrial Automation, and Renewable Energy.

Current-Carrying Wiring Device Manufacturing

This category involves the manufacturing of devices that carry electrical current to supply power to various electrical appliances and systems. These devices are essential for the distribution and control of electrical power within homes, businesses, and industrial facilities.

Examples of products: switches, sockets, and connectors

These products are used in Residential, Commercial, and Industrial environments to provide power to electronic devices and systems

Noncurrent-Carrying Wiring Device Manufacturing

This category involves the manufacturing of wiring devices that do not carry electrical current but are essential for the support, protection, and organization of electrical wiring systems. These devices help ensure the safe and efficient installation and operation of electrical systems.

Examples of products: cable management systems, electrical boxes, insulating material

These products are used in Residential, Commercial, and Industrial environments to provide power to electronic devices and systems

Industry Concentration Analysis

Despite the presence of companies vertically focused on just one segment, more than often companies in the electrical equipment industry tend to operate in different segments to better satisfy their customers’ needs benefiting from the synergies that products from different segments can generate.

Given the presence of many companies able to compete in different segments, is not surprising that the electrical equipment industry is highly competitive and fragmented registering a Herfindahl–Hirschman index (HHI index) of 0.02, or 229.5 points.

The Herfindahl–Hirschman index is used to measure the level of competitiveness/concentration in an industry with HHI below 0.15 (or 1.500 points) indicative of unconcentrated, or very competitive, industries; HHI between 0.15 and 0.25 (or 1.500 and 2.500 points) indicative of moderately concentrated industries; and HHI above 0.25 (or 2.500 points) suggesting that industries are highly concentrated, or scarcely competitive, like oligopolies.

Industry Performance

From 2013 to 2023, the industry’s revenues grew at a CAGR of 6.5%, increasing 1.9 times from $405 billion to $764 billion.

Profitability Metrics

As of the end of 2023, the industry’s operating margin stood at 8.9%, reflecting a better performance than the industry’s 10-year median value of 8.4%. The total operating profit was $67.7 billion in 2023.

Looking at other measures of profitability, in 2023 the gross margin sat at 24.9%, worse than the median value of 26.8%, while the free cash flow margin was 3.1% – in line with the past decade’s median value of 3.1%.

| 2023 Profitability Metrics | |

| Gross Margin | 24,9% |

| Operating Margin | 8,9% |

| FCFF Margin | 3,1% |

| 10Y Profitability Metrics | |

| Gross Margin | 26,8% |

| Operating Margin | 8,4% |

| FCFF Margin | 3,1% |

by BlackNote Investment

Collectively in 2023, the free cash flows to the firm (FCFF) registered a value equal to $23.5 billion.

| Year | FCFF |

| 2023 | 23.483 |

| 2022 | 18.903 |

| 2021 | 1.191 |

| 2020 | 13.655 |

| 2019 | 21.933 |

| 2018 | 15.237 |

| 2017 | 10.264 |

| 2016 | 17.284 |

| 2015 | 15.608 |

| 2014 | 22.371 |

| 2013 | 22.356 |

by BlackNote Investment ($ millions)

Financial Ratios

As regards solvency ratios, the debt-to-enterprise value ratio for the electrical equipment industry is 8.7%, while the debt-to-equity ratio is 35.7%.

The interest coverage ratio instead, showing how much the operating income covers interest expenses, is equal to 6.23, which would translate into a credit rating for the electrical equipment industry equal to A1/A+ based on Moody’s rating standards.

Finally, the unlevered beta of the electrical equipment industry – which is the beta depurated by the debt leverage – has been 0.73, for the past 2 years, and 0.85, for the past 5 years.

| Solvency Ratios | |

| Debt to EV | 8,7% |

| Debt to Equity | 35,7% |

| Interest Coverage | 6,23 |

| Rating | A1/A+ |

| Spread | 1,23% |

| Beta | |

| Unlevered Beta 2 y | 0,73 |

| Unlevered Beta 5 y | 0,85 |

by BlackNote Investment

Megatrends

Despite the electrical equipment industry is a mature market, with revenues growing around the mid-single-digits range – 10Y median revenues growth rate 5.5% – over the past years, the industry has witnessed the rise of secular trends that will likely support the future demand for electrical equipment devices.

Digitalization and AI

The rapid evolution of large language models (LLMs) and artificial intelligence (AI) is revolutionizing various industries. The need for extensive computational resources has led to a surge in demand for data centres, which heavily rely on power and cooling solutions to guarantee continuous operation.

Future data centres will likely incorporate advanced power and cooling technologies (e.g., liquid cooling, immersion cooling) to meet the increasing demand for high computational capabilities.

Climate change

The rising concern for climate change will force firms and governments to focus on replacing traditional energy sources with renewable ones, increasing efficiency, and promoting circular economy practices in the next decades.

Thus, buildings and industrial facilities will have to undertake structural changes pivoting towards greater energy efficiency. Advanced electrical equipment devices, able to efficiently manage the flow of energy, will likely play a key role in the achievement of such goals.

Smart buildings

Smart buildings equipped with connected products and applications are becoming essential for energy efficiency and improved living standards leading to an increasing need for real-time monitoring and management of energy consumption.

Energy transition

The push towards electrification and decarbonization is reshaping the energy landscape leading to the implementation of smart grids, to manage energy distribution efficiently and integrate renewable energy sources; advances in battery technology and other energy storage solutions, to ensure a stable energy supply; and increased adoption of electric vehicles (EVs).

Evolution of wealth

Electrification and data proliferation are creating opportunities in both developed and emerging economies, favouring the creation of new wealth.

The rise in countries’ overall wealth will create the necessity of upgrading infrastructure in mature economies, to meet citizens’ needs for greater quality of living and concerns on sustainability; and building new infrastructure in emerging economies, to meet the growing needs of the developing industrial and service sectors.

New global equilibrium

The aftermath of the COVID pandemic, and the outbreak of the Russian-Ucrainian war, exposed the inefficiency of supply chains forcing firms and public institutions to take action to avoid similar economic repercussions in the future.

It resulted in global supply chain shifts and reshoring trends, followed by an increasing focus on automation and electrification, which culminated in greater reliance on robotics and application of intelligent devices for manufacturing processes thus the integration of IoT and AI to create highly automated and efficient manufacturing facilities.

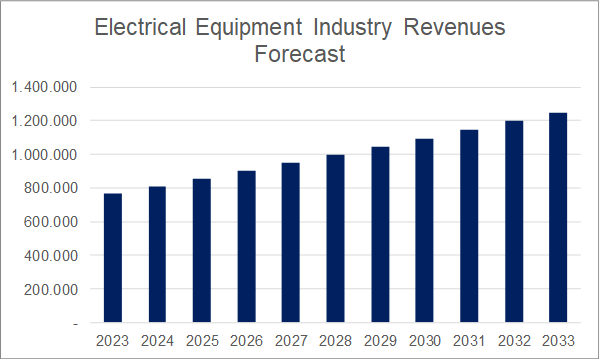

Industry Growth Forecasts

To capitalize on such opportunities, over the past decade, collectively the industry registered a median reinvestment margin of 4.4%, which comprises investments made in capital expenditures, R&D, and acquisitions.

In terms of efficiency and return on investments, the electrical equipment industry’s median sales to invested capital in the period 2013-2023 is equal to 1.39, meaning that on every dollar invested the industry generates $1.39 of revenues.

Combining both the reinvestments made through the past decade and the industry’s ability to generate a return from the investments made, the 2024 expected growth rate for the industry is 5.82%. A detailed explanation of how we came up with the industry’s expected growth rate, as well as many more useful industry data, can be found on this post on my website BlackNote Investment.

By 2033, the electric equipment industry revenues are expected to reach $1.25 trillion, increasing 1.6 times from the $764 billion registered in 2023 at a CAGR of 5%. We projected the industry’s expected revenues 10 years from now, applying the expected growth rate of 5.82% and allowing it to slowly decline as the industry approaches the economy’s perpetual growth rate, represented in this case by the USD risk-free rate.

| Electrical Equipment Industry Revenues Forecast | |

| 2023 | 764.008 |

| 2024 | 808.489 |

| 2025 | 853.992 |

| 2026 | 900.457 |

| 2027 | 947.820 |

| 2028 | 996.014 |

| 2029 | 1.044.973 |

| 2030 | 1.094.628 |

| 2031 | 1.144.912 |

| 2032 | 1.195.756 |

| 2033 | 1.247.090 |

by BlackNote Investment ($ millions)

Market Share and Competitors Analysis

The industry is highly competitive and no company has a dominant position. The following table provides a snapshot of the top 45 companies in the electrical equipment industry accounting for 75.2% of total market share by revenues.

| Company | 2023 Revenues | % 2023 Market Share | Rank |

| Contemporary Amperex Technology Co., Limited | 56.480 | 7,4% | 1° |

| Schneider Electric S.E. | 39.640 | 5,2% | 2° |

| Mitsubishi Electric Corporation | 37.030 | 4,8% | 3° |

| Siemens Energy AG | 35.000 | 4,6% | 4° |

| ABB Ltd | 32.240 | 4,2% | 5° |

| LG Energy Solution, Ltd. | 26.040 | 3,4% | 6° |

| Eaton Corporation plc | 23.200 | 3,0% | 7° |

| LS Corp. | 18.230 | 2,4% | 8° |

| Prysmian S.p.A. | 17.010 | 2,2% | 9° |

| Vestas Wind Systems A/S | 16.980 | 2,2% | 10° |

| Nidec Corporation | 16.300 | 2,1% | 11° |

| Shanghai Electric Group Co., Ltd. | 16.150 | 2,1% | 12° |

| Emerson Electric Co. | 15.910 | 2,1% | 13° |

| TBEA Co., Ltd. | 13.590 | 1,8% | 14° |

| Doosan Enerbility Co., Ltd. | 13.580 | 1,8% | 15° |

| Legrand SA | 9.290 | 1,2% | 16° |

| Rockwell Automation, Inc. | 9.130 | 1,2% | 17° |

| Sungrow Power Supply Co., Ltd. | 8.830 | 1,2% | 18° |

| Nexans S.A. | 8.600 | 1,1% | 19° |

| Dongfang Electric Corporation Limited | 8.000 | 1,0% | 20° |

| Fuji Electric Co., Ltd. | 7.650 | 1,0% | 21° |

| Sociedad Química y Minera de Chile S.A. | 7.470 | 1,0% | 22° |

| Furukawa Electric Co., Ltd. | 7.420 | 1,0% | 23° |

| Signify N.V. | 7.400 | 1,0% | 24° |

| Zhejiang Chint Electrics Co., Ltd. | 7.330 | 1,0% | 25° |

| Nordex SE | 7.160 | 0,9% | 26° |

| Hunan Yuneng New Energy Battery Material Co.,Ltd. | 6.930 | 0,9% | 27° |

| Vertiv Holdings Co | 6.860 | 0,9% | 28° |

| Sunwoda Electronic Co.,Ltd | 6.830 | 0,9% | 29° |

| NARI Technology Co., Ltd. | 6.820 | 0,9% | 30° |

| Goldwind Science And Technology Co., Ltd. | 6.790 | 0,9% | 31° |

| WEG S.A. | 6.700 | 0,9% | 32° |

| AMETEK, Inc. | 6.600 | 0,9% | 33° |

| EVE Energy Co., Ltd. | 6.510 | 0,9% | 34° |

| Walsin Lihwa Corporation | 6.180 | 0,8% | 35° |

| Jiangsu Zhongtian Technology Co., Ltd. | 6.000 | 0,8% | 36° |

| Ecopro Co., Ltd. | 5.980 | 0,8% | 37° |

| Fujikura Ltd. | 5.620 | 0,7% | 38° |

| Hubbell Incorporated | 5.370 | 0,7% | 39° |

| Ecopro BM. Co., Ltd. | 5.330 | 0,7% | 40° |

| Gotion High-tech Co.,Ltd. | 4.160 | 0,5% | 41° |

| Ming Yang Smart Energy Group Limited | 4.110 | 0,5% | 42° |

| Sensata Technologies Holding plc | 4.050 | 0,5% | 43° |

| Generac Holdings Inc. | 4.020 | 0,5% | 44° |

| GS Yuasa Corporation | 3.930 | 0,5% | 45° |

by BlackNote Investment ($ millions)

As regards the segment in which such companies operate, the Relay and Industrial Control Manufacturing and the Switchgear and Switchboard Apparatus Manufacturing are the two most competitive segments, with respectively 17 and 14 companies among those firms that account for 75% of the industry’s total revenues.

Following we have the Power, Distribution, and Specialty Transformer Manufacturing and the Battery Manufacturing segments, with 12 and 11 companies respectively.

The Motor and Generator Manufacturing instead, appears to be less competitive with only 5 major companies operating in the segment.

Looking at the geographical distribution of firms operating in the industry, China is by far the single country that accounts for the majority of firms, with 14 companies, followed by the USA with 7 companies, and Japan with 6 firms.

Market Share Forecasts

Basing our assumptions on analysts’ expectations (source: TIKR Terminal) and industry trends, we have estimated the future market share by 2033 for the top 20 companies operating in the industry and how their market position will change compared to 2023 levels.

| Company | 2033 Revenues | % 2033 Market Share | Change | Rank |

| Contemporary Amperex Technology Co., Limited | 107.229 | 8,6% | - | 1° |

| Schneider Electric S.E. | 64.849 | 5,2% | - | 2° |

| Siemens Energy AG | 57.284 | 4,6% | 1 ↑ | 3° |

| LG Energy Solution, Ltd. | 56.214 | 4,5% | 2 ↑ | 4° |

| ABB Ltd | 49.884 | 4,0% | - | 5° |

| Mitsubishi Electric Corporation | 49.035 | 3,9% | 3 ↓ | 6° |

| Eaton Corporation plc | 38.294 | 3,1% | - | 7° |

| Vestas Wind Systems A/S | 35.277 | 2,8% | 2 ↑ | 8° |

| Prysmian S.p.A. | 28.683 | 2,3% | - | 9° |

| Emerson Electric Co. | 26.812 | 2,2% | 3 ↑ | 10° |

| TBEA Co., Ltd. | 25.584 | 2,1% | 3 ↑ | 11° |

| Nidec Corporation | 25.095 | 2,0% | 1 ↓ | 12° |

| LS Corp. | 24.942 | 2,0% | 5 ↓ | 13° |

| Sungrow Power Supply Co., Ltd. | 24.933 | 2,0% | 4 ↑ | 14° |

| Shanghai Electric Group Co., Ltd. | 23.461 | 1,9% | 3 ↓ | 15° |

| Vertiv Holdings Co | 19.953 | 1,6% | 12 ↑ | 16° |

| Doosan Enerbility Co., Ltd. | 17.252 | 1,4% | 2 ↓ | 17° |

| AMETEK, Inc. | 16.212 | 1,3% | 15 ↑ | 18° |

| Rockwell Automation, Inc. | 13.665 | 1,1% | 2 ↓ | 19° |

| Legrand SA | 13.048 | 1,0% | 4 ↓ | 20° |

by BlackNote Investment ($ millions)

Selected Company Valuation

The following is a selection of companies operating in the electrical equipment industry for which we present a snapshot of their operations and valuation using the DCF method.

The comprehensive analysis of the selected companies is available on our Seeking Alpha profile where you can assess all the underlying assumptions for future growth, margins, free cash flows, and the quantified risk/reward of potential investments.

Eaton Corporation plc ($ETN)

Full Analysis on Seeking Alpha

Eaton Corporation is a U.S. company offering power management solutions.

Its business model is divided into three main categories: the Electrical segment, offering power distribution and control solutions such as switchgear and circuit breakers; the Aerospace segment, which provides a comprehensive list of electrical components like pumps, motors, and valves for the aircraft industry; and lastly the Vehicle & e-Mobility segment, offering electrical components used in both traditional and EV vehicles manufacturing.

Over the period 2013-2023, revenues grew at a CAGR of 0.5% slightly increasing from $22 billion to $23.2 billion, while its market share decreased from 5.4% to 3%.

| Eaton Corporation plc Past Performance | ||||

| 2013 | 2023 | CAGR | Increase | |

| Total revenues | 22.046 | 23.196 | 0,5% | x1,1 |

| Market Share | 5,4% | 3,0% | ||

by BlackNote Investment ($ millions)

Looking at measures of profitability, the median operating margin stands at 12.3%, the median gross margin sits at 32.3%, and the median free cash flow margin is 11.7% with free cash flows to the firm sitting at $3.3 billion in 2023.

| Eaton Corporation plc Profitability Metrics | ||

| 2023 | 10Y Median | |

| % Gross Margins | 36,4% | 32,3% |

| % Operating Margins | 17,0% | 12,3% |

| % FCFF Margins | 14,4% | 11,7% |

by BlackNote Investment

Over the past decade – considering R&D expenses as capital expenditures – the median reinvestment margin was equal to 1.6%. In terms of efficiency, the median ROIC was 9.4% while the sales to invested capital ratio sat at 0.86.

| Eaton Corporation plc Efficiency Metrics | ||

| 2023 | 10Y Median | |

| % Reinvestment Margins | (0,1%) | (0,1%) |

| % ROIC | 12,7% | 10,0% |

| Sales To IC | 0,89 | 0,87 |

by BlackNote Investment

Eaton’s market share is expected to be 3.1% by 2033, while its operating margin is projected to be around 20%. The reinvestment margins instead are expected to remain around 1.6%.

| Eaton Corporation plc Future Performance | ||||

| 2023 | 2033 | GAGR | Increase | |

| Expected Market Share | 3,0% | 3,1% | ||

| Total Revenues Projection | 23.196 | 38.294 | 5,1% | x1,7 |

| % Operating Margins Projection | 17,0% | 20,0% | ||

| % Reinvestment Margin Projection | (0,1%) | 1,6% | ||

| Free Cash Flows Firm Projection | 3.332 | 5.197 | 4,5% | x1,6 |

by BlackNote Investment ($ millions)

With these assumptions, using a discount rate of 8.8% in normal growth and 8.2% in perpetuity, the present value of Eaton’s cash flows is equal to $86 billion or $215 per share.

Emerson Electric Co. ($EMR)

Full Analysis on Seeking Alpha

Emerson is a U.S. based company operating in the Relay and Industrial Control Manufacturing segment.

Emerson’s portfolio of industrial automation products includes Intelligent Devices like solenoids and valves, used to control and regulate flows of liquids or gases to improve safety and efficiency; and Software Solutions, used in combination with measurement devices to control and maximise plants’ performances and safety.

Over the period 2013-2023, its market share decreased from 6.1% to 2% with revenues equal to $15.2 billion in 2023.

| Emerson Electric Co. Past Performance | ||||

| 2013 | 2023 | CAGR | Increase | |

| Total revenues | 24.669 | 15.165 | (4,7%) | x0,6 |

| Market Share | 6,1% | 2,0% | ||

by BlackNote Investment ($ millions)

Looking at measures of profitability, the median operating margin stands at 17.1%, the median gross margin sits at 43.1%, and the median free cash flow margin is 10.3% with free cash flows to the firm sitting at $1.97 billion in 2023.

| Emerson Electric Co. Profitability Metrics | ||

| 2023 | 10Y Median | |

| % Gross Margins | 49,0% | 43,1% |

| % Operating Margins | 19,1% | 17,1% |

| % FCFF Margins | 13,0% | 10,3% |

by BlackNote Investment

Over the past decade – considering R&D expenses as capital expenditures – the median reinvestment margin was equal to 5.1%. In terms of efficiency, the median ROIC was 16.3% while the sales to invested capital ratio sat at 1.29.

| Emerson Electric Co. Efficiency Metrics | ||

| 2023 | 10Y Median | |

| % Reinvestment Margins | 1,9% | 3,4% |

| % ROIC | 8,9% | 16,3% |

| Sales To IC | 0,60 | 1,29 |

by BlackNote Investment

Emerson’s market share is expected to be 2.2% by 2033, while its operating margin is projected to be around 22%. The reinvestment margins instead are expected to remain around 3.4%.

| Emerson Electric Co. Future Performance | ||||

| 2023 | 2033 | GAGR | Increase | |

| Expected Market Share | 2,0% | 2,2% | ||

| Total Revenues Projection | 15.165 | 26.812 | 5,9% | x1,8 |

| % Operating Margins Projection | 19,1% | 22,0% | ||

| % Reinvestment Margin Projection | 1,9% | 3,4% | ||

| Free Cash Flows Firm Projection | 1.972 | 3.568 | 6,1% | x1,8 |

by BlackNote Investment ($ millions)

With these assumptions, using a discount rate of 8% in both normal growth and perpetuity, the present value of Emerson’s cash flows is equal to $55.7 billion or $97.4 per share.

Vertiv Holdings Co. ($VRT)

Full Analysis on Seeking Alpha

Vertiv is a U.S. based company operating in the Switchgear and Switchboard Apparatus Manufacturing segment.

Vertiv’s operations are divided into three main areas: the Critical Infrastructure & Solutions, offering power and thermal management solutions, switchgear, and busbar; the Integrated Rack Solutions, offering integrated rack systems, modular solutions, and monitoring and control digital infrastructure; and lastly the Services & Spares segment, offering pre-and-post sales services.

Vertiv solutions primarily serve data centres, as power management and cooling solutions are essential for processing large amounts of data, which account for 75% of Vertiv revenues.

Over the period 2016-2023, revenues grew at a CAGR of 8.2% increasing 1.7 times from $3.9 billion to $6.9 billion, while its market share remained around 0.9%.

| Vertiv Holdings Co Past Performance | ||||

| 2016 | 2023 | CAGR | Increase | |

| Total revenues | 3.944 | 6.863 | 8,2% | x1,7 |

| Market Share | 1,1% | 0,9% | ||

by BlackNote Investment ($ millions)

Looking at measures of profitability, the median operating margin stands at 5.3%, the median gross margin sits at 33.4%, and the median free cash flow margin is 5.8% with free cash flows to the firm sitting at $971 million in 2023.

| Vertiv Holdings Co Profitability Metrics | ||

| 2016 | 7Y Median | |

| % Gross Margins | 35,0% | 33,4% |

| % Operating Margins | 13,4% | 5,3% |

| % FCFF Margins | 14,2% | 5,8% |

by BlackNote Investment

Over the past decade – considering R&D expenses as capital expenditures – the median reinvestment margin was equal to 1.4%. In terms of efficiency, the median ROIC was 4.8% while the sales to invested capital ratio sat at 1.57.

| Vertiv Holdings Co Efficiency Metrics | ||

| 2023 | 7Y Median | |

| % Reinvestment Margins | (2,6%) | (2,4%) |

| % ROIC | 17,4% | 9,9% |

| Sales To IC | 1,51 | 1,64 |

by BlackNote Investment

Vertiv’s market share is expected to be 1.6% by 2033, while its operating margin is projected to be around 22%. The reinvestment margins instead are expected to be around 4.4%.

| Vertiv Holdings Co Future Performance | ||||

| 2023 | 2033 | GAGR | Increase | |

| Expected Market Share | 0,9% | 1,6% | ||

| Total Revenues Projection | 6.863 | 19.953 | 11,3% | x2,9 |

| % Operating Margins Projection | 13,4% | 22,0% | ||

| % Reinvestment Margin Projection | (2,6%) | 4,4% | ||

| Free Cash Flows Firm Projection | 971 | 2.458 | 9,7% | x2,5 |

by BlackNote Investment ($ millions)

With these assumptions, using a discount rate of 11.6% in normal growth and 8.5% in perpetuity, the present value of Vertiv’s cash flows is equal to $32.9 billion or $88 per share.

AMETEK, Inc. ($AME)

Full Analysis on Seeking Alpha

AMETEK is a U.S. based company operating in the Relay and Industrial Control Manufacturing sector.

AMETEK is active in two niche segments called “Electronic Instruments” and “Electromechanical” offering process control instruments, high-precision automation solutions, medical components, thermal management systems, speciality metals, and electrical interconnects.

Its products are used in the life sciences, pharmaceutical, semiconductor, automation, food and beverage, aerospace and defence, medical, power, oil and gas, automotive, and renewable energy industries.

Over the period 2013-2023, revenues grew at a CAGR of 6.3% increasing 1.8 times from $3.6 billion to $6.6 billion, while its market share remained around 0.9%.

| AMETEK, Inc. Past Performance | ||||

| 2013 | 2023 | CAGR | Increase | |

| Total revenues | 3.594 | 6.597 | 6,3% | x1,8 |

| Market Share | 0,9% | 0,9% | ||

by BlackNote Investment ($ millions)

Looking at measures of profitability, the median operating margin stands at 22.8%, the median gross margin sits at 34.5%, and the median free cash flow margin is 6.8% with free cash flows to the firm sitting at negative ($499) million in 2023 due to acquisition occurred during the year.

| AMETEK, Inc. Profitability Metrics | ||

| 2023 | 10Y Median | |

| % Gross Margins | 36,1% | 34,5% |

| % Operating Margins | 25,9% | 22,8% |

| % FCFF Margins | (7,6%) | 6,8% |

by BlackNote Investment

Over the past decade – considering R&D expenses as capital expenditures – the median reinvestment margin was equal to 14.4%. In terms of efficiency, the median ROIC was 12.7% while the sales to invested capital ratio sat at 0.74.

| AMETEK, Inc. Efficiency Metrics | ||

| 2023 | 10Y Median | |

| % Reinvestment Margins | 28,7% | 9,4% |

| % ROIC | 14,4% | 14,5% |

| Sales To IC | 0,68 | 0,79 |

by BlackNote Investment

AMETEK’s market share is expected to be 1.3% by 2033, while its operating margin is projected to be around 28%. The reinvestment margins instead are expected to be around 9.4%.

| AMETEK, Inc. Future Performance | ||||

| 2023 | 2033 | GAGR | Increase | |

| Expected Market Share | 0,9% | 1,3% | ||

| Total Revenues Projection | 6.597 | 16.212 | 9,4% | x2,5 |

| % Operating Margins Projection | 25,9% | 28,0% | ||

| % Reinvestment Margin Projection | 28,7% | 9,4% | ||

| Free Cash Flows Firm Projection | (499) | 1.926 | N/A | N/A |

by BlackNote Investment ($ millions)

With these assumptions, using a discount rate of 8.4% in normal growth and 8.2% in perpetuity, the present value of AMETEK’s cash flows is equal to $28 billion or $121 per share.

Rockwell Automation, Inc. ($ROK)

Full Analysis on Seeking Alpha

Rockwell is a U.S. based company operating in the Relay and Industrial Control Manufacturing segment.

Its business model is divided into three main business lines: the Intelligent Devices segment, which includes drives and motion solutions and advanced material handling solutions; the Software & Control segment, offers control and visualization software; digital twin; and network and security infrastructure; and the Lifecycle Service segment offers consultation and professional services including engineered-to-order solutions.

Over the period 2013-2023, revenues grew at a CAGR of 3.6% increasing 1.4 times from $6.3 billion to $9.06 billion, while its market share decreased from 1.6% to 1.2%.

| Rockwell Automation, Inc. Past Performance | ||||

| 2013 | 2023 | CAGR | Increase | |

| Total revenues | 6.352 | 9.058 | 3,6% | x1,4 |

| Market Share | 1,6% | 1,2% | ||

by BlackNote Investment ($ millions)

Looking at measures of profitability, the median operating margin stands at 17.2%, the median gross margin sits at 41.6%, and the median free cash flow margin is 11.2% with free cash flows to the firm sitting at $1.07 billion in 2023.

| Rockwell Automation, Inc. Profitability Metrics | ||

| 2023 | 10Y Median | |

| % Gross Margins | 41,0% | 41,6% |

| % Operating Margins | 17,8% | 17,2% |

| % FCFF Margins | 11,8% | 11,2% |

by BlackNote Investment

Over the past decade – considering R&D expenses as capital expenditures – the median reinvestment margin was equal to 5.8%. In terms of efficiency, the median ROIC was 32.1% while the sales to invested capital ratio sat at 2.38.

| Rockwell Automation, Inc. Efficiency Metrics | ||

| 2023 | 10Y Median | |

| % Reinvestment Margins | 2,3% | 1,9% |

| % ROIC | 19,1% | 33,6% |

| Sales To IC | 1,35 | 2,37 |

by BlackNote Investment

Rockwell’s market share is expected to be 1.1% by 2033, while its operating margin is projected to be around 20%. The reinvestment margins instead are expected to be around 1.9%.

| Rockwell Automation, Inc. Future Performance | ||||

| 2023 | 2033 | GAGR | Increase | |

| Expected Market Share | 1,2% | 1,1% | ||

| Total Revenues Projection | 9.058 | 13.665 | 4,2% | x1,5 |

| % Operating Margins Projection | 17,8% | 20,0% | ||

| % Reinvestment Margin Projection | 2,3% | 1,9% | ||

| Free Cash Flows Firm Projection | 1.071 | 1.819 | 5,4% | x1,7 |

by BlackNote Investment ($ millions)

With these assumptions, using a discount rate of 9.4% in normal growth and 8.2% in perpetuity, the present value of Rockwell’s cash flows is equal to $28.9 billion or $254 per share.

Generac Holdings Inc. ($GNRC)

Full Analysis on Seeking Alpha

Generac is a U.S. based company operating in the Motor and Generator Manufacturing segment.

Generac products comprise backup and power generation products, a.k.a. standby generators, battery storage systems, energy monitoring & management devices, and for a lesser part EV home charging solutions. For strategic purposes, its operations are divided into three main business lines: Residential, Commercial and Industrial, and Other products and services.

Over the period 2013-2023, revenues grew at a CAGR of 10.5% increasing 2.7 times from $1.49 billion to $4.02 billion, while its market share increased from 0.4% to 0.5%.

| Generac Holdings Inc. Past Performance | ||||

| 2013 | 2023 | CAGR | Increase | |

| Total revenues | 1.486 | 4.023 | 10,5% | x2,7 |

| Market Share | 0,4% | 0,5% | ||

by BlackNote Investment ($ millions)

Looking at measures of profitability, the median operating margin stands at 17%, the median gross margin sits at 35.8%, and the median free cash flow margin is 6.1% with free cash flows to the firm sitting at $438 million in 2023.

| Generac Holdings Inc. Profitability Metrics | ||

| 2023 | 10Y Median | |

| % Gross Margins | 33,9% | 35,8% |

| % Operating Margins | 9,6% | 17,0% |

| % FCFF Margins | 10,9% | 6,1% |

by BlackNote Investment

Over the past decade – considering R&D expenses as capital expenditures – the median reinvestment margin was equal to 8.3%. In terms of efficiency, the median ROIC was 14.1% while the sales to invested capital ratio sat at 1.16.

| Generac Holdings Inc. Efficiency Metrics | ||

| 2023 | 10Y Median | |

| % Reinvestment Margins | (3,7%) | 6,3% |

| % ROIC | 7,7% | 14,3% |

| Sales To IC | 1,07 | 1,30 |

by BlackNote Investment

Generac’s market share is expected to be 0.8% by 2033, while its operating margin is projected to be around 17%. The reinvestment margins instead are expected to be around 7%.

| Generac Holdings Inc. Future Performance | ||||

| 2023 | 2033 | CAGR | Increase | |

| Expected Market Share | 0,5% | 0,8% | ||

| Total Revenues Projection | 4.023 | 9.174 | 8,6% | x2,3 |

| % Operating Margins Projection | 9,6% | 17,0% | ||

| % Reinvestment Margin Projection | (3,7%) | 6,9% | ||

| Free Cash Flows Firm Projection | 438 | 600 | 3,2% | x1,4 |

by BlackNote Investment ($ millions)

With these assumptions, using a discount rate of 8.7% in normal growth and 8.3% in perpetuity, the present value of Generac’s cash flows is equal to $7.9 billion or $130.4 per share.

If you are looking for financial data to support your valuations, on BlackNote Investment you can find the expected growth rate for 37 different industries used to forecast companies’ future revenues.

Additionally, the site offers useful data such as equity risk premiums for 39 different countries, used for calculating discount rates, as well as expected earnings growth rates for those countries based on analysts’ expectations.

Detailed industry and sector reports are also available, containing data like total revenues, total free cash flows, median operating margins, return on capital, as well as beta and financial ratios used to assess companies’ risk.

Feel free to use them in your analysis.