The following analysis considers the 234 major publicly listed software companies with a market capitalisation above $1 billion. The numbers in the tables are expressed in millions of dollars except for percentages and ratios.

If you are looking for more comprehensive historical data about the software industry, please refer to this page contaning the most relevant industry data going back to 2012.

Summary:

- Industry Overview

- Cloud Computing

- Cybersecurity

- Others

- Industry Performance

- Market Share and Competitors Analysis

- Regulatory Compliance

- Estimate Industry Growth

- Selected Company Valuation

Industry Overview

The software industry comprises all those companies that develop, distribute, and maintain software products and services. The software industry can be divided into three sub-segments, companies operating in the Cloud Computing segment, companies operating in the Cybersecurity segment, and all other companies developing specific software solutions for Other niche segments.

Cloud Computing

Cloud computing, from now on simply cloud, refers to the on-demand availability of computer resources – mainly for data storage and computing power – without the need to physically own, or actively manage, the computer hardware, and in most cases, even the software.

Thanks to cloud services, the organization can move its workload from the on-premises computer, better-called servers, to the cloud. Cloud servers are dedicated computers located in data centres placed in different locations all over the globe and managed by cloud provider companies.

Cloud providers are companies that set up the data centres and offer their servers, hence computing resources, to third parties that, for example, need those computing capabilities to run applications or to store and process data. The third parties then, pay a fee to the cloud providers usually based on the amount of computing power they use. This service is called computer as a service (CaaS).

The primary benefits of moving the workload from on-premises serves to the cloud are a significant reduction in up-front capital expenses to purchase and set up IT infrastructure, such as hardware, and IT maintenance operating costs, as well as a significant reduction of operational risks, as relying on cloud servers eliminates the risks of failure of on-premises hardware due to power outages or damages to hardware components.

The second benefit of cloud solutions is a greater scalability, whether up or down, of computing resources. If with traditional on-premises servers, a company would usually have to wait for the procurement team to purchase a new server, and then wait for the IT team to get it up and running, with cloud computing the company can instantaneously, and unilaterally, increase its computing resources by increasing the usage of servers’ time or network storage. On the other hand, if the computer resources are no longer needed, with cloud solutions the company can immediately, and unilaterally, reduce usage of servers’ time or network storage, reducing operating costs, while with on-premises servers, the company will likely continue incurring in maintenance and obsolescence costs.

Essential solutions leveraging on cloud services are compute power; data storage; access and management of databases, data warehouses, and data lakes; data analytics; machine learnings; access management; and customer engagement & relationships.

Delivery Model

Cloud services companies, usually offer their solutions under three different models: Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS).

IaaS

With the Infrastructure as a Service model, cloud providers will manage the servers, data storage, virtualisation, and cloud networking, while the client will maintain control and ownership over middleware, operating systems, and software applications.

Virtualisation refers to simulated hardware in a virtual environment. Instead of having multiple physical servers, running different applications, an organization can set up a unique server, running different applications using different virtual machines (VMs), each with dedicated software. A Hypervisor is the software used to create virtual machines and is in charge of allocating and controlling servers’ resources, like RAM and CPU.

By leveraging virtualisation, organizations eliminate the costs needed to set up hardware and maintain it. Also, thanks to VMs, servers’ computing capacity is maximised. However, VM drawback is that they consume a lot of storage, RAM, and CPU resources. To overcome this problem, so-called “containers” can be used.

Differently from VMs, containers only include the application that needs to be run, bundled with all the features needed to run it. Containers can be hosted in any server without requiring additional hardware or software which would take resources from servers, resulting to be way faster and cheaper to operate than VMs.

PaaS

With Platform as a Service model, cloud providers will manage the servers, data storage, virtualisation, cloud networking, operating systems, and middleware. The client will maintain control and ownership only over the software applications they choose to deploy on the cloud platform.

SaaS

With the Software as a Service model, cloud providers will manage the servers, data storage, virtualisation, networking, operating systems, middleware, and software applications. The client then, will immediately have access to up-and-running software applications without worrying about hardware capacity or software development.

Cloud solutions can be private, operated solely for a single client and are usually very capital intensive as they still require significant hardware but permit full control over sensible data; public, shared by multiple customers and very flexible as it is usually priced on a pay-per-use basis; or hybrid, leveraging on a mix of private and public solutions.

Multicloud instead, refers to the use of different cloud services from different cloud providers, reducing the reliance on single vendors and avoiding the so-called “Vendor Lock-In” effect. Cloud vendors apply significant egress fees (or exit fees) to reduce the portability of workloads from cloud to cloud, locking clients within the vendors’ cloud environment.

Revenue Model

Cloud companies can be divided into two main categories, cloud providers and cloud services companies.

Cloud providers, like Amazon Web Services (AWS), Google Cloud Platform (GCP), Microsoft Azure, Oracle Cloud, Alibaba Cloud, and IBM Cloud, provide the full spectrum of IaaS, PaaS, and SaaS solutions, usually under a consumption-based model, with fees revenues depending on how much clients use servers’ time and network storage, or under a more traditional subscription plan.

Cloud providers’ business model is notably capital intensive as it requires significant up-from investments to set up data centres and networking infrastructures. However, given the remarkable investments, the segment is characterized by a high barrier to entry, with only three players, namely AWS, GCP, and Azure, controlling the whole market.

Cloud services companies instead, like Salesforce, ServiceNow, Nutanix, GitLab, and UiPath, usually rely on cloud providers’ infrastructure to deliver specific SaaS solutions tackling different customers’ needs. Revenues are mostly collected on a subscription basis, even though some players offer pay-as-you-go payment models. Cloud services companies are far less capital intensive with primary operating costs represented by fees paid to cloud providers to access their infrastructure. Due to the significantly lower barriers to entry, the segment is highly competitive as new players with relatively similar solutions can easily access the market and rapidly conquer market shares.

Other than pure cloud services companies, there are companies like Cloudflare and Fastly, offering content delivery network solutions, which despite offering SaaS solutions to their clients, must invest in network infrastructure, and maintain it, to deliver its solutions. At the same time, however, they might still rely on cloud providers for critical cloud infrastructure. Revenues are usually recognized on a consumption-based model.

Cybersecurity

Cybersecurity refers to the protection of computer systems from malicious attacks, in the form of hardware and software damages, theft of data, leakage of private information, or disruptions of operations, that might result from systems’ vulnerability.

Thanks to cybersecurity solutions, organizations can individuate vulnerable systems in time and prevent cyber-attacks. Examples of the most common cyber-attacks are:

Backdoor: represents any method of bypassing normal authentication controls to access private networks.

Denial-of-services (DoS) – Distributed-denial-of-services (DDoS): are attacks aimed at making computers and networks unable to perform their tasks and services. While DoS are easier to identify and block, DDoS coming from multiple IP addresses are more difficult to counter.

Malware: malicious software with the objective of damaging computer systems by leaking, corrupting, or damaging private information, passwords, and data, or worse, giving control of computer systems to hackers. Ransomware is a type of malware, which firstly corrupts computer systems to then demand a ransom to obtain back the control over the system. Malware usually takes the form of computer viruses, which contain malicious code that once opened hijacks software and copies itself to infect more computer systems.

Man-in-the-middle (MITM): refers to an attack from malicious third parties intercepting a communication between two parties.

Phishing: refers to the attempt to obtain sensible information by misleading its owner into sharing them, usually by emails and messages.

Computer security is measured by three processes: threat prevention, detection, and response.

Threat prevention is the most crucial aspect and can be achieved, among others, through cryptography, known as the implementation of protocols that prevent third parties from accessing private information; endpoint security, referring to the protection of computer network from attacks arriving from wireless devices such as smartphones and laptops; firewalls, which are network security systems that act as a shield to block malicious attack to the system both in the form of software and hardware; and zero trust security models, where, by default, the system do not trust any device and users, even if connected to the organization’s network or already previously identified.

Detection solutions instead, comprise Intrusion Detection Systems (IDS), like extender detection and response (XDR) solutions, which are used to detect real-time attacks on the systems.

Finally, response, such as the intervention of anti-malware or anti-virus, comprises all set of counteractions initiated to mitigate the damage, and report the attack, after a menace has been detected.

Revenue Model

The cybersecurity segment is composed of legacy cybersecurity companies, like Palo Alto Networks and Fortinet, usually boosting a broad range of cybersecurity solutions, both hardware and software, sold under a license or subscription model; and cloud-native cybersecurity companies, comprising younger players like CrowdStrike, Zscaler, and SentinelOne, completing leveraging on the cloud to offer SaaS solutions under a subscription model, to modernize the way organization approach cybersecurity.

Others

Other than cloud computing and cybersecurity companies, the software industry is fragmented into several niche markets where software development companies target specific customers’ needs like Adobe and Synopsis, offering creative and design software; Zoom Video, offering communications and collaboration software; AppLoving, offering marketing and sales software; Intuit, offering financial software; and Unity Software, offering software for the gaming and 3D industry.

Despite not all companies directly competing in the cloud computing segment, as seen in the cybersecurity segment, after the advent of the cloud almost the entirety of software companies have switched their revenue and delivery models towards a more SaaS-oriented subscription model to leverage the immense benefits of the cloud.

Industry Performance

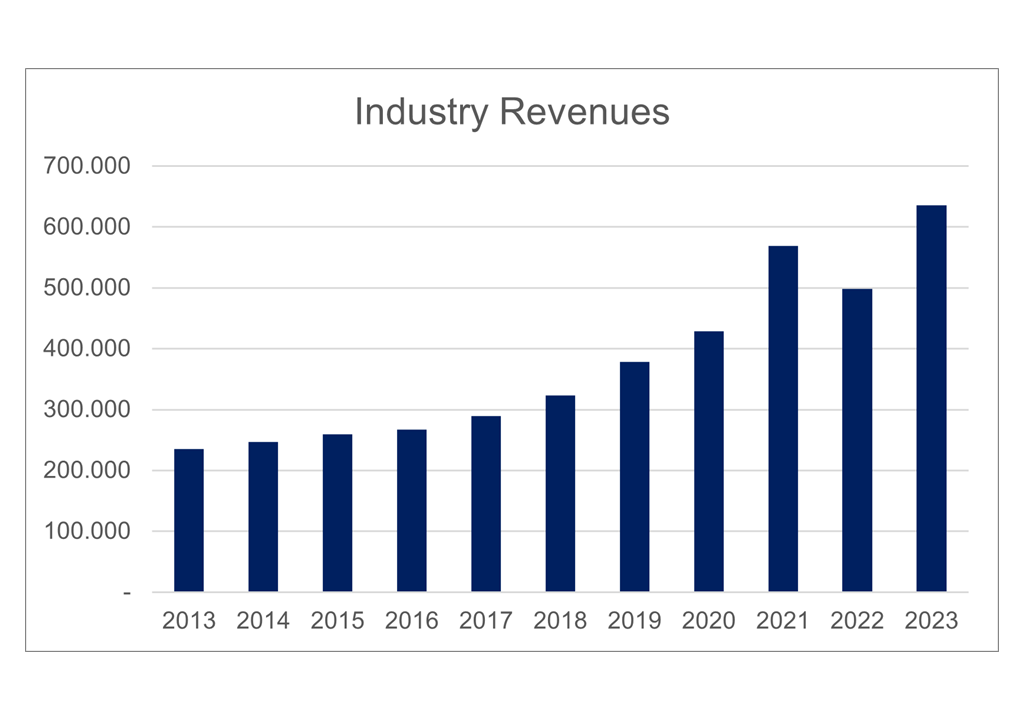

From 2013 to 2023, the industry’s revenues grew at a CAGR of 10.4%, increasing 2.7 times from $235.3 billion to $635.1 billion.

Profitability Metrics

As of 2023, the industry’s operating margin stood at 25.3%, reflecting in-line performance with the industry median value of 22.3% of the past decade. The total operating profit was $160.5 billion.

Looking at other measures of profitability, in 2023 the gross margin sat at 70.3%, better than the median value of 67.4%, while the free cash flow margin was 8.2% – slightly worse than the past decade’s median value of 10.7%.

| 2023 Profitability Metrics | |

| Gross Margin | 70,3% |

| Operating Margin | 25,3% |

| FCFF Margin | 8,2% |

| 10Y Profitability Metrics | |

| Gross Margin | 67,4% |

| Operating Margin | 22,3% |

| FCFF Margin | 10,7% |

by BlackNote Investment

Collectively in 2023, the free cash flows to the firm (FCFF) registered a value equal to $51.8 billion.

| Year | FCFF |

| 2023 | 51.788 |

| 2022 | 47.700 |

| 2021 | 55.758 |

| 2020 | 64.774 |

| 2019 | 38.627 |

| 2018 | 46.727 |

| 2017 | 2.070 |

| 2016 | 38.675 |

| 2015 | 33.537 |

| 2014 | 19.143 |

| 2013 | 40.323 |

by BlackNote Investment

Financial Ratios

As regards solvency ratios, the debt-to-enterprise value ratio for the software industry is 2.4%, while the debt-to-equity ratio is 15%.

The interest coverage ratio instead, showing how much the operating income covers interest expenses, is critically low at 0.56, which would translate into a credit rating for the software industry equal to C2/C based on Moody’s rating standards.

Finally, the unlevered beta of the software industry – which is the beta depurated by the debt leverage – has been 1.13 for the past 2 years, and 0.85 for the past 5 years.

| Solvency Ratios | |

| Debt to EV | 2,4% |

| Debt to Equity | 15,0% |

| Interest Coverage | 0,56 |

| Rating | C2/C |

| Spread | 17,50% |

| Beta | |

| Unlevered Beta 2 y | 1,13 |

| Unlevered Beta 5 y | 0,85 |

by BlackNote Investment

Market Share and Competitors Analysis

The software industry is moderately concentrated registering a Herfindahl–Hirschman index (HHI index) of 14.5, or 1.447 points.

The Herfindahl–Hirschman index is used to measure the level of competitiveness/concentration in an industry with HHI below 0.15 (or 1.500 points) indicative of unconcentrated, or very competitive, industries; HHI between 0.15 and 0.25 (or 1.500 and 2.500 points) indicative of moderately concentrated industries; and HHI above 0.25 (or 2.500 points) suggesting that industries are highly concentrated, or scarcely competitive, like oligopolies.

However, when considering the three sub-segments composing the industry, the cloud computing segment – accounting also for cloud revenues generated by non-software companies like AWS and Google Cloud – is the most concentrated, registering an HHI of 0.231 (or 2310 points), while the cybersecurity segment results to be more competitive with an HHI of 0.137 (or 1374 points).

The following table provides a snapshot of the top 22 companies in the software industry accounting for 75% of total market share by revenues.

| Company | 2023 Revenues | % 2023 Market Share | Rank |

| Microsoft Corporation | 227.580 | 35,8% | 1° |

| Oracle Corporation | 52.510 | 8,3% | 2° |

| Salesforce, Inc. | 34.860 | 5,5% | 3° |

| SAP SE | 34.450 | 5,4% | 4° |

| Adobe Inc. | 19.940 | 3,1% | 5° |

| Intuit Inc. | 15.090 | 2,4% | 6° |

| ServiceNow, Inc. | 8.970 | 1,4% | 7° |

| Constellation Software Inc. | 8.410 | 1,3% | 8° |

| Palo Alto Networks, Inc. | 7.530 | 1,2% | 9° |

| Workday, Inc. | 7.260 | 1,1% | 10° |

| Dassault Systèmes SE | 6.570 | 1,0% | 11° |

| Roper Technologies, Inc. | 6.180 | 1,0% | 12° |

| Synopsys, Inc. | 6.130 | 1,0% | 13° |

| Open Text Corporation | 5.700 | 0,9% | 14° |

| Autodesk, Inc. | 5.500 | 0,9% | 15° |

| Fortinet, Inc. | 5.300 | 0,8% | 16° |

| Zoom Video Communications, Inc. | 4.530 | 0,7% | 17° |

| Cadence Design Systems, Inc. | 4.090 | 0,6% | 18° |

| Asseco Poland S.A. | 3.950 | 0,6% | 19° |

| Atlassian Corporation | 3.890 | 0,6% | 20° |

| NCR Voyix Corporation | 3830 | 0,6% | 21° |

| Gen Digital Inc. | 3790 | 0,6% | 22° |

by BlackNote Investment

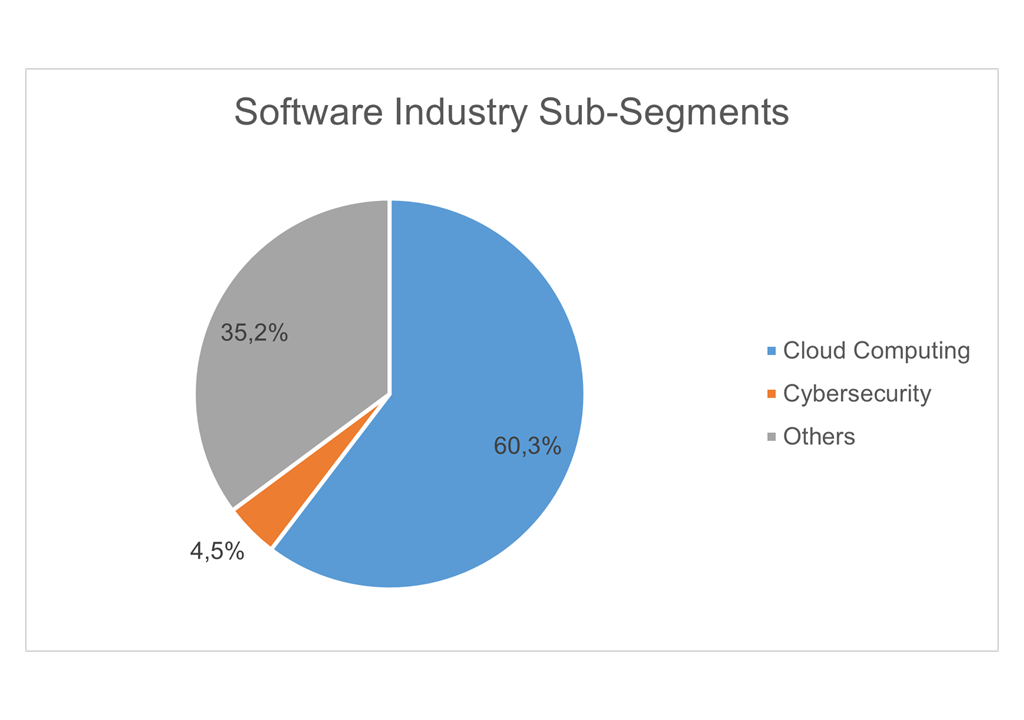

As regards the three sub-segments, cloud computing accounts for 60.3% of the total market share, exclusive of the cloud revenues generated by non-software companies like AWS and Google Cloud, otherwise, the total market share will adjust to 68.1% when adding cloud revenues generated by non-software companies to the total.

The cybersecurity segment accounts for only 4.5% – 3.6% when considering non-software cloud companies – while the remaining 35.2% of revenues are generated by companies operating in other niche segments.

Regulatory Compliance

Although the blossom of cloud and cybersecurity solutions benefits the software industry, over the past years concerns for data protection and individual privacy protection have risen among governments and international institutions.

This led to the introduction of stringent regulations and frameworks that software companies must comply with to ensure the protection of both their clients and their clients’ customers’ data and information from any potential threat.

Examples of regulations firms are obliged to comply with are:

Data protection and privacy regulations, like the EU GDPR and the Californian CCPA.

Cross-border data transfer regulations, like the EU-U.S. Data Privacy Framework, providing a detailed mechanism for the transfer of personal data from the EU to the U.S.

Cybersecurity regulations, a set of policy frameworks for computer security on how organizations can prevent cyber-attacks like the NIST Cybersecurity Framework and EU Network and Information Systems Directive.

Estimate Industry Growth

The blossom of the internet at the beginning of the 21st century and the mass adoption of cloud computing have been two major drivers for the rapid expansion of the software industry. Nowadays, given the ongoing digitalization trends and sprout of AI technologies, software solutions are embedded in people’s everyday lives more than ever.

To capitalize on such opportunities, over the past decade, collectively the industry registered a median reinvestment margin of 18.4%, which comprises investments made in capital expenditures, R&D, and acquisitions.

In terms of efficiency and return on investments, the software industry median sales to invested capital in the period 2013-2023 is equal to 0.76, meaning that on every one dollar invested the industry generates $0.76 of revenues.

Combining both the reinvestments made through the past decade and the industry’s ability to generate a return from the investments made, the 2024 expected growth rate for the industry is 14.07%. A detailed explanation of how we came up with the industry’s expected growth rate, as well as many more useful industry data, can be found on this post.

Among all 37 industries analysed on our equity research platform, the software industry places 3rd among the fastest-growing industries, only behind the interactive media industry and the semiconductor industry, boosting a 2024 expected revenue growth rate of 15.4% and 14.9% respectively.

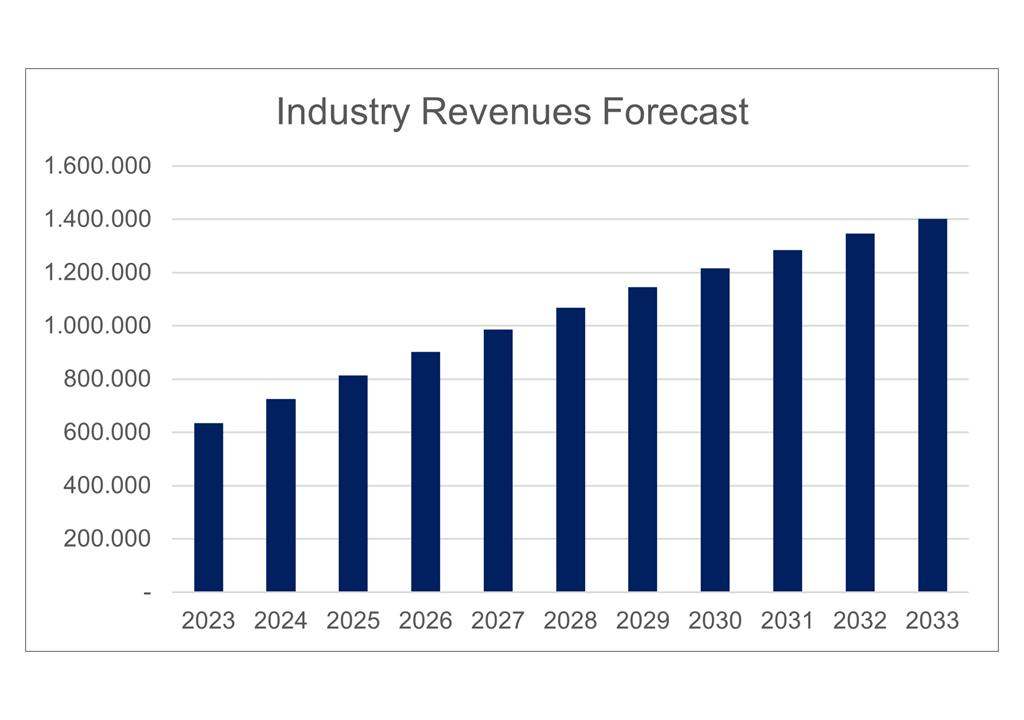

By 2033, the software industry revenues are expected to reach $1.4 trillion, increasing 2.2 times from the $635.1 billion registered in 2023 at a CAGR of 8.2%. We projected the industry’s expected revenues 10 years from now, applying the expected growth rate of 14.07% and allowing it to slowly decline as the industry approaches the economy’s perpetual growth rate, represented in this case by the USD risk-free rate.

| Software Industry Revenues Forecast | |

| 2023 | 635.157 |

| 2024 | 724.543 |

| 2025 | 813.741 |

| 2026 | 901.377 |

| 2027 | 986.296 |

| 2028 | 1.067.581 |

| 2029 | 1.144.548 |

| 2030 | 1.216.732 |

| 2031 | 1.283.861 |

| 2032 | 1.345.824 |

| 2033 | 1.402.645 |

by BlackNote Investment

Selected Company Valuation

The following is a selection of companies operating in the IT services industry for which we present a snapshot of their operations and valuation using the DCF method.

The comprehensive analysis of the selected companies is available on our Seeking Alpha profile where you can assess all the underlying assumptions for future growth, margins, free cash flows, and the quantified risk/reward of potential investments.

Salesforce, Inc

Full Analysis on Seeking Alpha

Salesforce is a US company operating in the cloud services segment offering customer relationship management (CRM) solutions.

Over the period 2013-2023, revenues grew at a CAGR of 24% increasing from $4.07 billion to $34.8 billion, while its market share increased from 1.7% to 5.5%.

| Salesforce, Inc. Past Performance | ||||

| 2013 | 2023 | CAGR | Increase | |

| Total revenues | 4.071 | 34.857 | 24,0% | x8,6 |

| Market Share | 1,7% | 5,5% | ||

by BlackNote Investment

Looking at measures of profitability, the adjusted median operating margin stands at 14.3%, the median gross margin sits at 74.4%, and the median free cash flow margin is (0.3%) with free cash flows to the firm sitting at $4.6 billion in 2023.

| Salesforce, Inc. Profitability Metrics | ||

| 2023 | 10Y Median | |

| % Gross Margins | 75,5% | 74,4% |

| % Operating Margins | 17,2% | 2,6% |

| % FCFF Margins | 13,1% | (0,3%) |

by BlackNote Investment

Over the past decade, the median reinvestment margin was equal to 12%. In terms of efficiency, the median ROIC was 7.6% while the sales to invested capital ratio sat at 1.08.

| Salesforce, Inc. Efficiency Metrics | ||

| 2023 | 10Y Median | |

| % Adj Reinvestment Margin | 10,9% | 12,0% |

| % ROIC | 7,6% | 1,6% |

| Sales To IC | 0,53 | 1,08 |

by BlackNote Investment

Salesforce’s market share is expected to be 5.2% by 2033, while its operating margin is projected to improve to 35%. The reinvestment margins instead are expected to be 4%.

| Salesforce, Inc. Future Performance | ||||

| 2023 | 2033 | CAGR | Increase | |

| Expected Market Share | 5,5% | 5,2% | ||

| Total Revenues Projection | 34.857 | 72.938 | 7,7% | x2,1 |

| % Operating Margins Projection | 26,8% | 35,0% | ||

| % Reinvestment Margin Projection | 10,9% | 4,0% | ||

| Free Cash Flows Firm Projection | 4.569 | 16.484 | 13,7% | x3,6 |

by BlackNote Investment

With these assumptions, using a discount rate of 10% in normal growth and 9.6% in perpetuity, the present value of Salesforce’s cash flows is equal to $201.9 billion or $208.4 per share.

ServiceNow, Inc

Full Analysis on Seeking Alpha

ServiceNow is a US company operating in the cloud services segment offering PaaS solutions.

Over the period 2013-2023, revenues grew at a CAGR of 35.7% increasing from $425 million to $8.9 billion, while its market share increased from 0.2% to 1.4%.

| ServiceNow, Inc. Past Performance | ||||

| 2013 | 2023 | CAGR | Increase | |

| Total revenues | 425 | 8.971 | 35,7% | x21,1 |

| Market Share | 0,2% | 1,4% | ||

by BlackNote Investment

Looking at measures of profitability, the adjusted median operating margin stands at 14.4%, the median gross margin sits at 76.1%, and the median free cash flow margin is (3.2%) with free cash flows to the firm sitting at $793 million in 2023.

| ServiceNow, Inc. Profitability Metrics | ||

| 2023 | 10Y Median | |

| % Gross Margins | 78,6% | 76,1% |

| % Adj. Operating Margins | 24,8% | 14,4% |

| % FCFF Margins | 8,8% | (3,2%) |

by BlackNote Investment

Over the past decade, the median reinvestment margin was equal to 18%. In terms of efficiency, the median ROIC was 2% while the sales to invested capital ratio sat at 1.81.

| ServiceNow, Inc. Efficiency Metrics | ||

| 2023 | 10Y Median | |

| % Adj Reinvestment Margin | 22,1% | 18,0% |

| % ROIC | 22,6% | 2,0% |

| Sales To IC | 1,55 | 1,81 |

by BlackNote Investment

ServiceNow’s market share is expected to be 5.5% by 2033, while its operating margin is projected to improve to 50%. The reinvestment margins instead are expected to be 18%.

| ServiceNow, Inc. Future Performance | ||||

| 2023 | 2033 | CAGR | Increase | |

| Expected Market Share | 1,4% | 5,5% | ||

| Total Revenues Projection | 8.971 | 77.145 | 24,0% | x8,6 |

| % Operating Margins Projection | 24,8% | 50,0% | ||

| % Reinvestment Margin Projection | 22,1% | 18,0% | ||

| Free Cash Flows Firm Projection | 793 | 15.467 | 34,6% | x19,5 |

by BlackNote Investment

With these assumptions, using a discount rate of 10.4% in normal growth and 9.7% in perpetuity, the present value of ServiceNow’s cash flows is equal to $170.9 billion or $832 per share.

Palantir Technologies, Inc

Full Analysis on Seeking Alpha

Palantir is a US company operating in the cloud services segment offering SaaS solutions.

Over the period 2018-2023, revenues grew at a CAGR of 30.2% increasing from $595 million to $2.2 billion, while its market share increased from 0.2% to 0.4%.

| Palantir Technologies Inc. Past Performance | ||||

| 2018 | 2023 | CAGR | Increase | |

| Total revenues | 595 | 2.225 | 30,2% | x3,7 |

| Market Share | 0,2% | 0,4% | ||

by BlackNote Investment

Looking at measures of profitability, the adjusted median operating margin stands at (24.7)%, the median gross margin sits at 78%, and the median free cash flow margin is (34.2%) with free cash flows to the firm sitting at ($308) million in 2023.

| Palantir Technologies Inc. Profitability Metrics | ||

| 2023 | 5Y Median | |

| % Gross Margins | 80,6% | 78,0% |

| % Adj. Operating Margins | 15,0% | (24,7%) |

| % FCFF Margins | 6,0% | (34,2%) |

by BlackNote Investment

Over the past five years, the median reinvestment margin was equal to 23.5%. In terms of efficiency, the median ROIC was 96.9%.

| Palantir Technologies Inc. Efficiency Metrics | ||

| 2023 | 5Y Median | |

| % Adj Reinvestment Margin | 8,6% | 23,5% |

| % ROIC | 37,5% | 96,9% |

| Sales To IC | 7,59 | (1,22) |

by BlackNote Investment

Palantir’s market share is expected to be 1.4% by 2033, while its operating margin is projected to improve to 45%. The FCFF margins instead are expected to be 25%.

| Palantir Technologies Inc. Future Performance | ||||

| 2023 | 2033 | CAGR | Increase | |

| Expected Market Share | 0,4% | 1,4% | ||

| Total Revenues Projection | 2.225 | 19.421 | 24,2% | x8,7 |

| % Operating Margins Projection | 15,0% | 45,0% | ||

| % FCFF Margins | 6,0% | 25,0% | ||

| Free Cash Flows Firm Projection | 134 | 4.855 | 43,1% | x36,1 |

by BlackNote Investment

With these assumptions, using a discount rate of 9.5% in normal growth and in perpetuity, the present value of Palantir’s cash flows is equal to $52.5 billion or $23.6 per share.

Snowflake, Inc

Full Analysis on Seeking Alpha

Snowflake is a US company operating in the cloud services segment offering SaaS solutions.

Over the period 2018-2023, revenues grew at a CAGR of 96.1% increasing from $97 million to $2.8 billion, while its market share increased to 0.4%.

| Snowflake Inc. Past Performance | ||||

| 2018 | 2023 | CAGR | Increase | |

| Total revenues | 97 | 2.806 | 96,1% | x29,0 |

| Market Share | 0,0% | 0,4% | ||

by BlackNote Investment

Looking at measures of profitability, the adjusted median operating margin stands at (39.2)%, the median gross margin sits at 90.7%, and the median free cash flow margin is (69.2%) with free cash flows to the firm sitting at ($963) million in 2023.

| Snowflake Inc. Profitability Metrics | ||

| 2023 | 5Y Median | |

| % Gross Margins | 68,0% | 60,7% |

| % Adj. Operating Margins | 0,9% | (39,2%) |

| % FCFF Margins | (34,3%) | (69,2%) |

by BlackNote Investment

Over the past five years, the median reinvestment margin was equal to 34%. In terms of efficiency, the median ROIC was (22.6%).

| Snowflake Inc. Efficiency Metrics | ||

| 2023 | 5Y Median | |

| % Adj Reinvestment Margin | 35,8% | 34,0% |

| % ROIC | (22,6%) | (22,6%) |

| Sales To IC | 0,59 | 0,53 |

by BlackNote Investment

Snowflake’s market share is expected to be 1.5% by 2033, while its operating margin is projected to improve to 45%. The reinvestment margins instead are expected to be 18.4%.

| Snowflake Inc. Future Performance | ||||

| 2023 | 2033 | CAGR | Increase | |

| Expected Market Share | 0,4% | 1,5% | ||

| Total Revenues Projection | 2.806 | 20.617 | 22,1% | x7,3 |

| % Operating Margins Projection | 0,9% | 45,0% | ||

| % Reinvestment Margin Projection | 35,8% | 18,4% | ||

| Free Cash Flows Firm Projection | (963) | 3.629 | N/A | N/A |

by BlackNote Investment

With these assumptions, using a discount rate of 9.2% in normal growth and in perpetuity, the present value of Snowflake’s cash flows is equal to $33.1 billion or $98.9 per share.

If you are looking for financial data to support your valuations, on BlackNote Investment you can find the expected growth rate for 37 different industries used to forecast companies’ future revenues.

Additionally, the site offers useful data such as equity risk premiums for 39 different countries, used for calculating discount rates, as well as expected earnings growth rates for those countries based on analysts’ expectations.

Detailed industry and sector reports are also available, containing data like total revenues, total free cash flows, median operating margins, return on capital, as well as beta and financial ratios used to assess companies’ risk.

Feel free to use them in your analysis.